Eliminating Compliance Debt: The Key to Healthcare Tech Innovation

Table of Contents

Healthcare IT leaders know how critical it is to innovate and expand their digital offerings for improved patient experiences. But 75% of healthcare CISOs and CIOs report that the stringent security measures and compliance mandates they must meet for protecting PHI in the cloud throttle their capacity to innovate.

What exactly is the invisible barrier to healthcare innovation that few people talk about? It’s a term unheard by many yet felt by all in the industry: Compliance debt.

Now, we must ask ourselves — what exactly is compliance debt, and how does it negatively impact progress in healthcare technology?

The term ‘debt’ typically carries negative connotations, signaling an obligation yet to be fulfilled. In the domain of IT and compliance, however, the concept of debt extends far beyond the financial realm. Debt can encompass all aspects of technology, security, and human resources, and it has far reaching and potentially catastrophic implications for your organization.

What is Compliance Debt

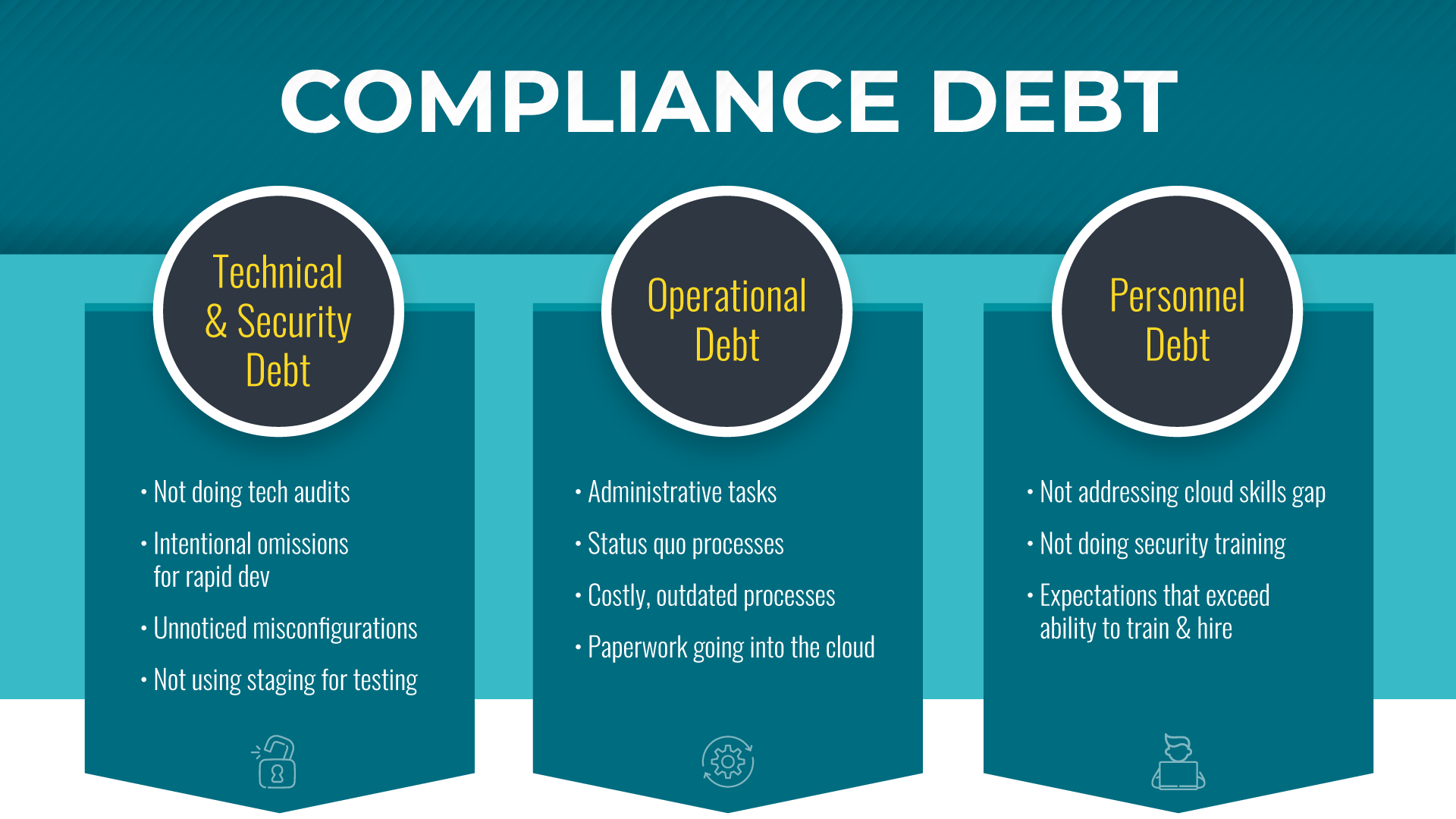

/noun/: The accumulation of technical, operational and personnel requirements to reach and maintain a state of compliance.

Compliance debt is the sum of technical, security, operational, and personnel debts in regulatory compliance. An organization may have a robust security infrastructure at its core but may find itself non-compliant due to technical debts – for instance, the lack of regular patching – which exposes it to penalties and legal ramifications.

Much like financial debt, compliance debt is a result of doing things quick and dirty. It incurs ‘interest payments’ in the form of lost innovation resources to compliance cycles, breach resolutions and negative fiscal impact to fund unforeseen expenses from each.

It is akin to paying your health insurance. You may not get the full value every year, but if you don’t have it and fall drastically ill or get hit by a bus you’ll be in debt for the rest of your life if not bankrupt.

This post explores the nuances of compliance debt and its intersections with technical debt, security debt, personnel debt, and operational debt highlighting the significant influence of these financial obligations on businesses.

Defining the Debts

What is Technical Debt (Tech Debt)

/noun/: The trade-off between short-term gains by delivering a quick-and-dirty solution versus long-term productivity and maintainability.

We’re all familiar with “tech debt.” It accrues when a development team chooses to implement expedient but suboptimal code that will require additional work to be considered properly engineered. Tech debt closely parallels financial debt; just as a loan with interest causes future payments to increase, tech debt manifests as higher maintenance costs, decreased system value, and, potentially, reduced compliance.

While not immediately detrimental, tech debt compounds over time, becoming a significant hurdle to innovation and product maturity. In the context of compliance, outdated or hastily patched IT systems can lead to gaps in regulatory adherence, heightening the risk of non-compliance penalties or, worse, data breaches.

What is Security Debt?

/noun/: A subset of technical debt – the accumulation of vulnerabilities in your software or security posture that make it harder or even impossible to defend your data and systems from attack.

Security debt arises in environments where constraints like time, expertise, or resources result in insufficient security protocols, practices, or infrastructures. Unresolved vulnerabilities, inadequate risk assessments or under-resourced security teams often surface. When security takes a backseat to immediacy, an organization accumulates a ‘debt’ of unaddressed risks and undefined security boundaries. This hidden debt can lead to a catastrophic breach, impacting an organization’s finances, reputation, and customer trust. In the context of healthcare, a breach can negatively impact patient care and safety.

Together with compliance debt, security debt emphasizes the importance of aligning security measures with regulatory requirements. Any laxity in security execution becomes a vulnerability, potentially compromising the entire compliance framework.

What is Operational Debt?

/noun/: The accumulation of inefficiencies, outdated processes, and unresolved issues that occur due to short-term decisions and the postponement of necessary operational improvements or investments.

Operational debt is analogous to technical debt in software development, where temporary, quick-fix solutions or delayed updates lead to increased costs, reduced efficiency, and more significant problems over time. Operational debt can significantly hamper an organization’s ability to grow, compete, and innovate. It often requires strategic planning, investment in resources, and a commitment to continuous improvement to resolve and prevent operational debt from undermining an organization’s success.

What is Personnel Debt?

/noun/: When professionals lose skills or fail at keeping up with new skill requirements, making it hard to grow or maintain their current environment.

Within cybersecurity, the skills shortage serves as a pathway to inefficiencies and potential errors, heightening the risk of breaches and unaddressed vulnerabilities. This is especially true in healthcare, where 65% of HCOs report significant gaps in their cybersecurity teams with lengthy training periods of about 2.5 years for each employee. Likewise, when compliance demands surpass the organization’s capacity to train or recruit the necessary workforce, a scenario laden with errors and oversights unfolds.

Personnel Debt becomes particularly perilous in the context of phishing attempts and human error-induced hacking incidents. Personnel Debt can amplify the vulnerability of an organization to cyberattacks, highlighting the critical need for equipping individuals against sophisticated hacking strategies that prey on human errors.

Personnel debt is demonstrative of the intrinsic connection between individuals and processes in secure and compliant entities. It transcends mere tools and policies, emphasizing the pivotal role of capable individuals in realizing organizational potential towards overarching compliance and security objectives.

Assessing and Eliminating Compliance Debt

Assessing compliance debt is crucial and demands a comprehensive grasp of an organization’s technical, security, and human resource landscapes. By investing in robust IT governance, effective cyber defense mechanisms, and developing a skilled workforce, organizations can begin reducing their compliance debt.

The journey towards debt-free compliance can be challenging, but a proactive approach can mitigate risks, cut costs, and cultivate an organizational culture that prioritizes long-term security and stability. The fallout from non-compliance can include legal penalties, reputational damage, and a hemorrhaging customer base. In the healthcare industry, with fines up to $50K per record and the average cost of a breach hovering at $4.5M, an investment in security and compliance is crucial to mitigate risk. Conversely, it can be hard to fully fund if the ROI is not clearly defined, leading to a greater risk exposure than CISOs prefer; especially since they can be held liable if they are negligent in securing PHI.

By focusing on both compliance and security, organizations reduce costly and time-consuming remediations or retroactively address misconfigurations. In fact, 65% of organizations who make the shift to ensure continuous compliance revealed an increase in cloud benefits including cost savings, accelerated go to market strategies, and improved patient care.

It’s Time for Action

Understanding security and compliance debt is the path to clarity on the investments required to de-risk your business from threats to cybersecurity and compliance. If you can quantify the potentially negative financial and safety impacts of cyberthreats resulting from compliance debt, you can accurately estimate and lock in your fiscal investment up front.

A CISO and CIO conversation can now go from: “I can’t do everything I need to with what I have,” to “This is how much investment we need to appropriately de-risk the business from cyber threats and return dollars back to your budget with improved efficiencies so that we can focus our efforts on growing our business; not just defending it.”

With this investment, you can minimize the physical demands to stay compliant and mitigate the financial risks of cyber breaches resulting from non-compliance; further reducing the cost of compliance cycles and protecting the negative impact of breaches from being out of compliance.

It’s time to move from a reactive approach to a proactive approach.

Sign up for a Cloud Risk Checkup for a full report on your compliance status.

Quantify risk and justify the ROI.